We have divided all the relevant ESG matters in five main focus areas:

Solutions

HVG Law offers a broad range of legal solutions and support to help clients across industries and around the globe with their growing ESG & sustainability needs. Based on our firm’s areas of expertise, we offer the following solutions related to ESG topics.

Corporate Sustainability Reporting Directive

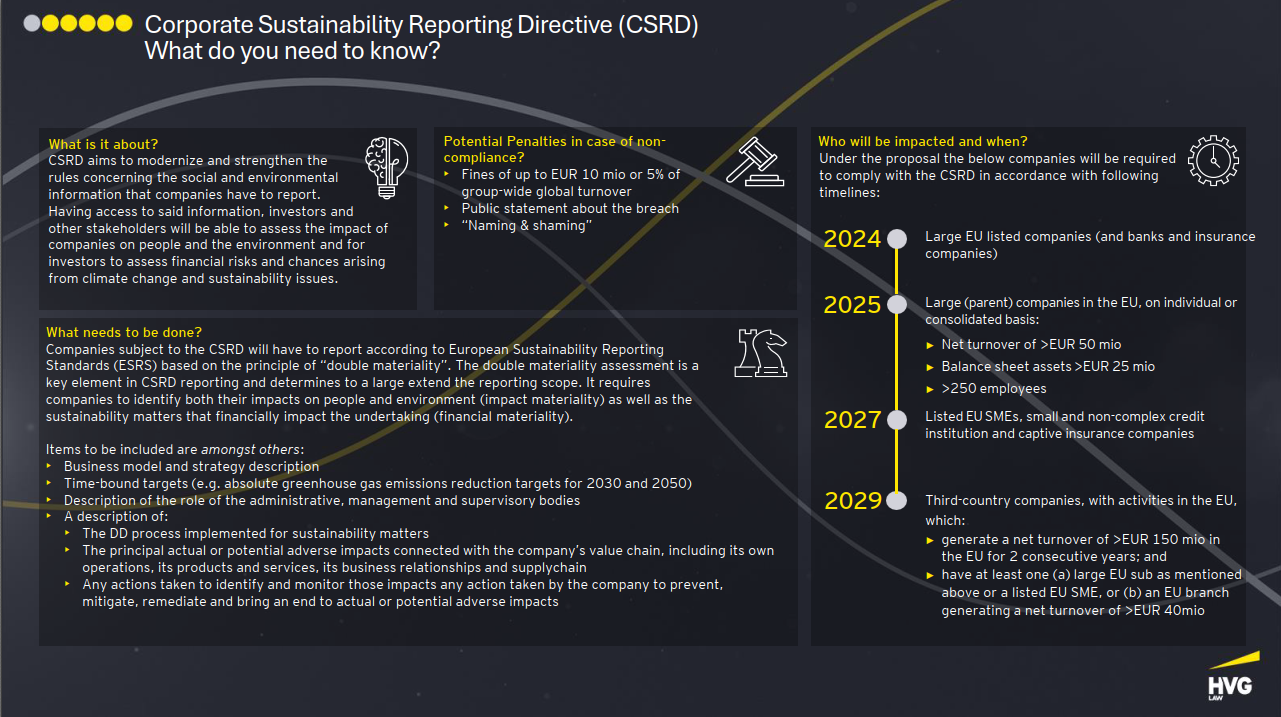

The Corporate Sustainability Reporting Directive (CSRD) is a directive adopted by the European Union (EU) and has entered into force on 5 January 2023. The Netherlands has not yet fully transposed the CSRD into Dutch law. As a result, the European Commission has issued a warning to the Netherlands, urging the latter to transpose the CSRD into national legislation by 31 December 2024.

The CSRD amends the existing Non-Financial Reporting Directive (NFRD) to enhance corporate transparency on sustainability issues. It introduces more detailed reporting requirements and significantly expands the scope of companies obligated to disclose information on environmental, social, and governance (ESG) factors. Although the CSRD entered into force on 5 January 2023, it introduces a phased implementation plan. For example, large listed companies need to report in accordance with the CSRD for financial years starting on or after 1 January 2024..

Navigating the complexities of the CSRD requires a thorough understanding and careful planning. HVG Law offers, together with EY Tax/ EY Law, comprehensive support to help your company achieve compliance efficiently.. We have extensive experience in conducting CSRD applicability assessments for cross-border multinationals. A crucial first step in becoming compliant for CSRD.

European Union Deforestation Regulation

The European Union Deforestation Regulation (EUDR) is a crucial element of the European Green Deal, aimed at reducing the EU’s contribution to global deforestation and forest degradation. Companies involved in the trade of commodities such as cattle, cocoa, coffee, palm oil, rubber, soy, and wood must adhere to stringent due diligence requirements to ensure their products comply with the regulation. HVG Law offers. Together with EY Tax/ EY Law, comprehensive legal support, including risk analysis, legal assessments, and assistance with drafting commercial contracts to help businesses align with EUDR requirements.

Corporate Sustainability Due Diligence Directive

The Corporate Sustainability Due Diligence Directive (CS3D) introduces significant obligations for companies regarding the prevention and mitigation of human rights and environmental violations within their operations, subsidiaries, and supply chains. The directive applies to large EU and non-EU companies with substantial global operations, depending on the number of employees and turnover thresholds. Key compliance deadlines range from 2027 to 2029, depending on company size and revenue. Non-compliance can result in severe penalties, including fines up to 5% of global turnover, exclusion from public procurement, and personal liability for management. Affected companies will need to establish robust risk management systems, conduct regular risk assessments, and implement preventive measures, such as updating contractual clauses and policies, as well as conducting audits and supplier training. HVG Law can, together with EY Tax/ EY Law, assist businesses by reviewing sustainability reporting, analyzing global supply chain policies, and helping implement necessary changes in the legal framework.

Green Claims Directive

The Green Claims Directive (GCD) is an EU regulatory framework aimed at combating ‘greenwashing’ by ensuring that companies make substantiated, transparent environmental claims. The GCD applies to most companies and impacts several corporate functions, including Marketing and Advertising, Legal & Compliance, and Product Development. Non-compliance can result in penalties such as fines of up to 4% of annual turnover, confiscation of revenues, and exclusion from public procurement opportunities. Once the GCD enters into force, Member States will have 24 months to implement the directive. HVG Law provides, together with EY Tax/EY Law, expert guidance to help companies comply, offering services such as reviewing existing claims, developing verification processes, and aligning business strategies with GCD requirements.

ESG en Due Diligence

In today’s business landscape ESG factors play a critical role in the investment process. Consequently, investors are increasingly recognizing the importance of ESG due diligence and compliance throughout the M&A process. Particularly in private equity and venture capital investments amongst green funds and impact investing companies, ESG factors form a pivotal part of the investment strategy. To address this growing need, we offer both legal due diligence on ESG factors and provide customized clauses in transaction documentation as well as post-transaction ESG integration. We will provide you with recommendations and guidance on actions to safeguard compliance with and (further) improve on ESG factors, both during the transaction and at the implementation thereof.

In addition to our expertise in transactional M&A due diligence, HVG Law also assists with internal ESG compliance assessments. We help you evaluate ESG topics that are relevant to your organization and provide a detailed description of the objectives and approach of the internal ESG compliance assessment. This assessment helps you proactively manage ESG risks and opportunities, enhancing your company’s sustainability and compliance with evolving regulations.

Equal Pay Directive

The Equal Pay Directive is an important step towards closing the gender pay gap within the EU. This directive is adopted by the European Union (EU) and has entered into force on 10 May 2023 and should be implemented in to Dutch legislation by 7 June 2026 The directive aims to create more transparency and accountability regarding pay structures. For the Netherlands, this directive has several implications:

Pay Transparency:

- Employers must be transparent about their pay policies and structures. This means that employees have the right to receive information about the pay of colleagues in similar positions, without having to disclose their own salary. This is intended to identify and address unjustified pay gaps.

- Dutch companies, especially larger organizations, are required to regularly report on their pay structures and the gender pay gap.

Burden of Proof on Employers:

- If an employee suspects they are being paid unfairly based on gender, the employer must prove that the pay is fair and based on objective criteria.

Sanctions and Fines:

- The directive requires member states to introduce effective sanctions for companies that do not comply with the rules.

Preventive Measures for Gender Discrimination:

- Employers will also need to take preventive measures to avoid gender discrimination in their pay structures. This may lead to stricter internal audits and adjustments to HR processes to ensure women are treated equally.

Legal Solutions: HVG Law, together with EY PAS, provides tools that analyze payroll data, making it easier for our clients to meet basic reporting obligations. The data offers valuable insights on which HR policies can be created or adjusted, and we can advise on their implementation to ensure compliance with the directive. Finally, we offer more in-depth analysis of various employment terms, recruitment, and pay policies, reviewing them for compliance with the principles of the directive.